Thursday, December 14, 2017, 12:00 pm

News Flash Archive

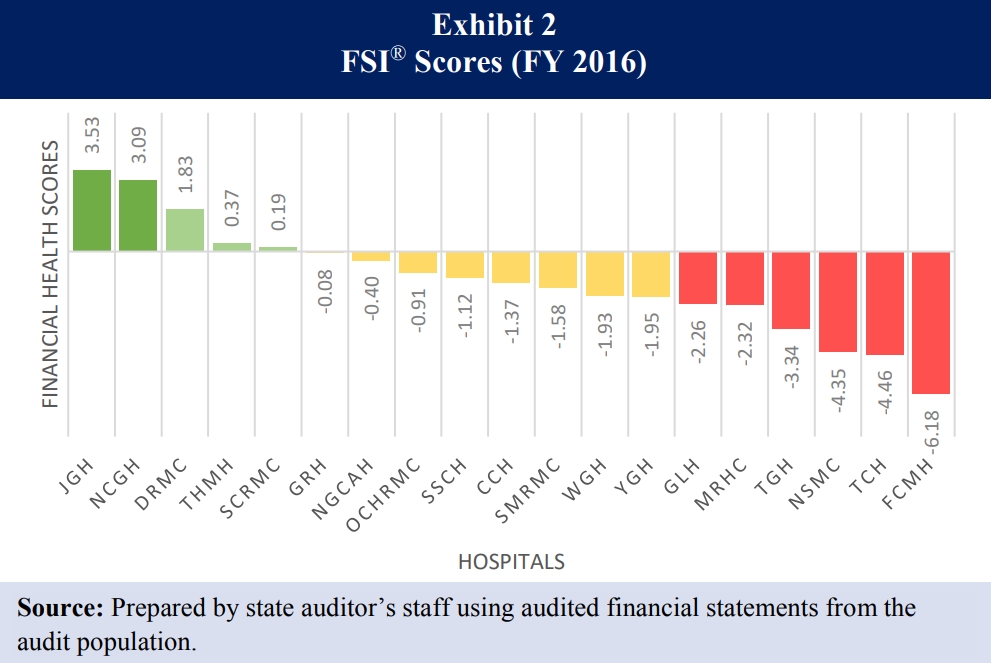

On Wednesday, Mississippi State Auditor Stacey Pickering released his findings regarding the financial strength of the state's rural hospitals. Greenwood Leflore Hospital (GLH) was one of 6 hospitals that rated "POOR" on the Financial Strength Index (FSI).

The auditor's report may be viewed here: State Auditor Report on Rural Hospital Financial Strength

Other area hospitals rated POOR include Tallahatchie General and North Sunflower Medical Center in Ruleville.

Area hospitals rating FAIR include South Sunflower County Hospital in Indianola.

Area hospitals rating GOOD include DRMC in Greenville, and Tyler Holmes in Winona.

The auditor utilized the Financial Strength Index (FSI), a widely used metric to determine a hospital's financial strength. It takes into account percent revenue over expenses (profitability), amount of debt financing (the lower the better), the days of cash on hand, and the accumulated depreciation. A hospital with high profitability, low debt, high days of cash on hand, and low accumulated depreciation is a financially strong institution.

According to the audit report, GLH has 144 staffed beds, and an average occupancy of 68 patients. It wrote off $35.3 million in uncollectible debt in FY2016. In Leflore County, 16.4% of the under-65 population have no health insurance.

42.3% of Leflore county residents are classified as "in poverty", compared to 20.8% state-wide, and 12.7% nation-wide.

GLH's precipitous fall in financial strength followed the adoption of the new GASB accounting standards that more accurately reflect the impact of pensions payable by the Hospital on its financial picture. This resulted in a $15.9 million dollar decline in net starting position.

GLH had a negative profitability in FY2016 of -4.66%. It has a higher then normal accumulated depreciation, meaning that its facilities are old and need replacing. It has too low a "days of cash on hand" reserve. On the plus side, GLH has a lower than average debt financing cost.

The audit report recommends that GLH review whether some of its equipment should be sold to lower its equipment costs, which are higher than the average.

Generally, the report provides some recommendations which should be followed to restore financial strength to rural hospitals. These recommendations include the need to update and upgrade facilities and available services to capture more well-paying patient demographics with private insurance, who are exiting the rural hospital market due to negative perceptions of facilities and quality of services.

Another recommendation is to implement better business practices relating to account management and processing charges and payments from patients and insurance carriers. Inefficiencies in these areas result in the failure to capture charges and missed revenue.

For complete coverage of these and other hospital milestones, please go here: Taxpayers Channel coverage of Greenwood Leflore Hospital's downfall.

John Pittman Hey

The Taxpayers Channel

News Flash Archive